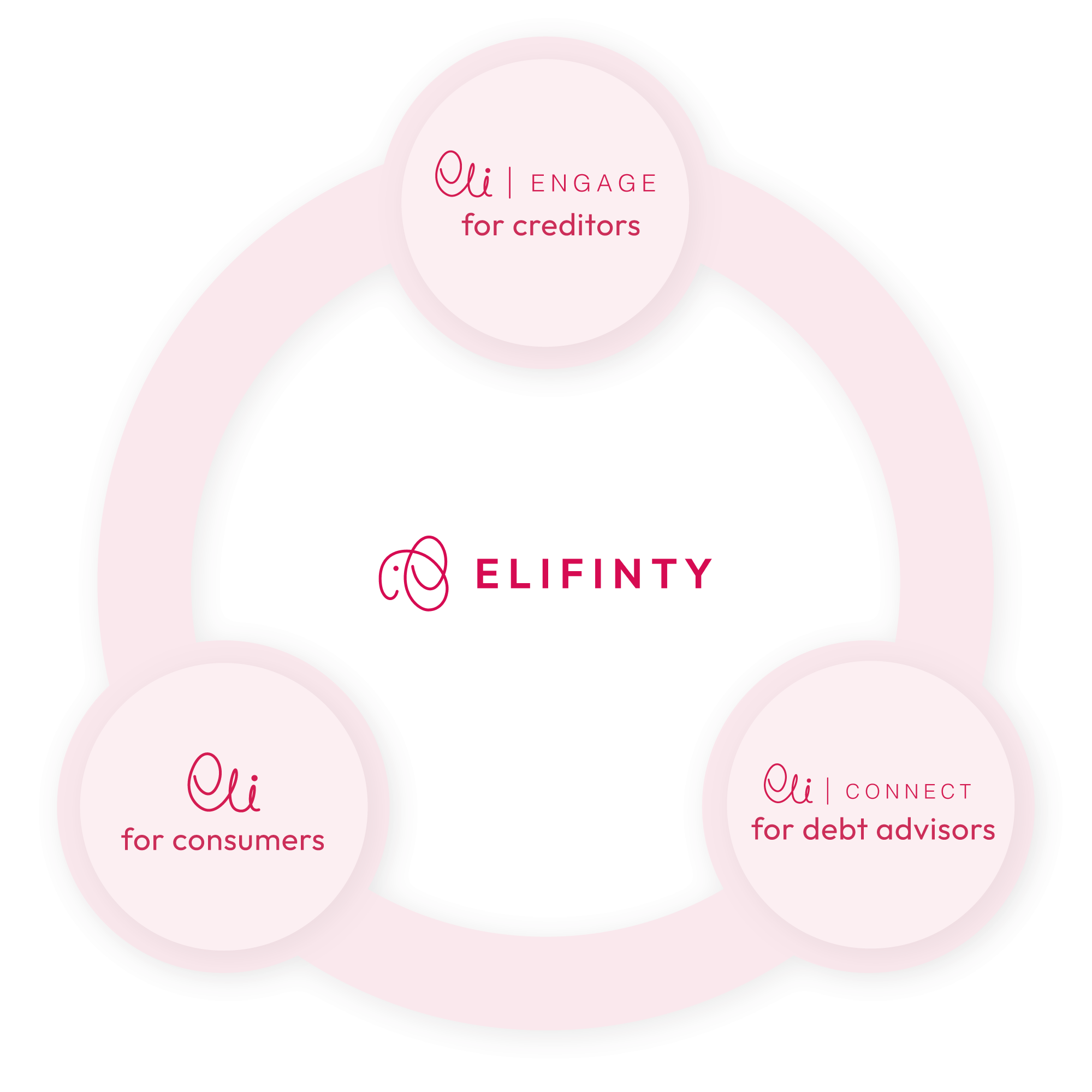

For people in debt

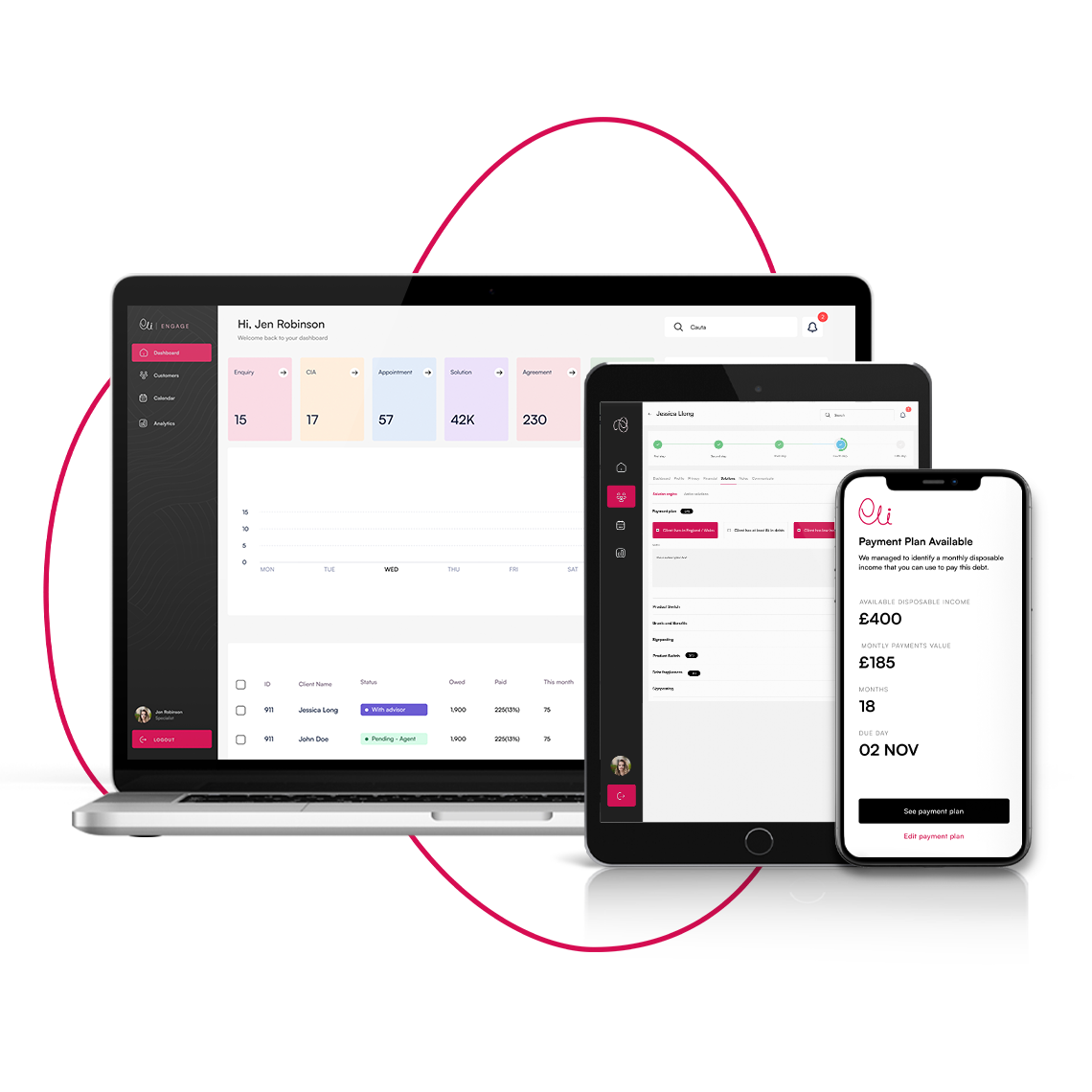

With our customer-facing Eli platform, people in debt can build open, honest relationships with their creditors, access non-judgemental advice and take control of their financial future.

- Debt advice available digitally or in person

- In-app communications with your creditors

- Budgeting and financial optimisation tools

- Access to eligible benefits, grants and reliefs

- Secure data and document sharing

For creditors and advisors

Deliver actionable support to the right people at the right time with EliEngage for creditors and EliConnect for debt advice agencies, each designed to help you streamline the debt resolution process ethically.

- Full visibility of customers with GDPR compliance

- Solutions engine to pre-empt and prevent defaulting

- Open banking for quick and easy data collection

- Prioritisation of cases and adjustable payment plans

- In-app communications and automated payment reminders