EliEngage is here to help

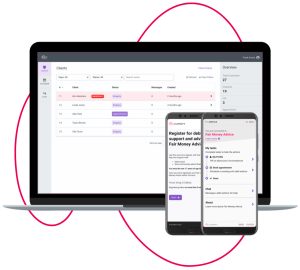

EliEngage is a customer engagement platform designed to reduce the impact of debt on your firm and customers. Grounded in social consciousness, it connects you to your customers and your customers to the support they need within one digital interface.

Our AI-enabled platform allows you to gain full visibility of your customers’ financial circumstances, create affordable payment plans for those in arrears and determine the next best steps for those at risk of delinquency – while ensuring end-to-end regulatory compliance.

With EliEngage, you’ll streamline how you work alongside people with problem debt, all while helping your customers to become their best financial selves.

With Elifinty, you could cut the time it takes to resolve an open debt case by 50%.