EliEngage is here to help

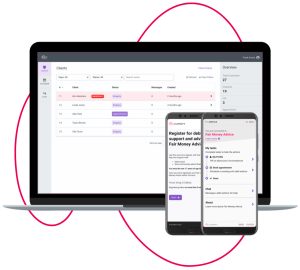

Help your residents work towards brighter financial futures with EliEngage, our customer engagement platform grounded in socially conscious practices. By connecting creditors, advisors and residents dealing with debt, our digital platform makes it easy for you to create relationships based on transparency and trust.

You can supercharge your advisors with our smart capabilities, support your residents with actionable insights and work towards debt resolutions successfully and fairly. With EliEngage, start communicating with your tenants directly to improve collections and develop healthier financial tomorrows.

EliEngage increases successful debt recovery by 40%*

*Compared to traditional debt recovery methods.